Available 24/7

Se Habla Español

Free Case Evaluation

Evaluación gratuita de caso

(919) 438-0065

If you or a loved one has been bitten by a dog in North Carolina, you’re likely facing more than just physical pain. There are medical bills, questions about legal liability, and uncertainty about what comes next. Fortunately, North Carolina law provides clear steps for how to respond and outlines when a dog owner may be held legally responsible. This guide breaks down everything you need to know—from immediate medical care to potential lawsuit compensation—while keeping you informed of your rights under NC law.

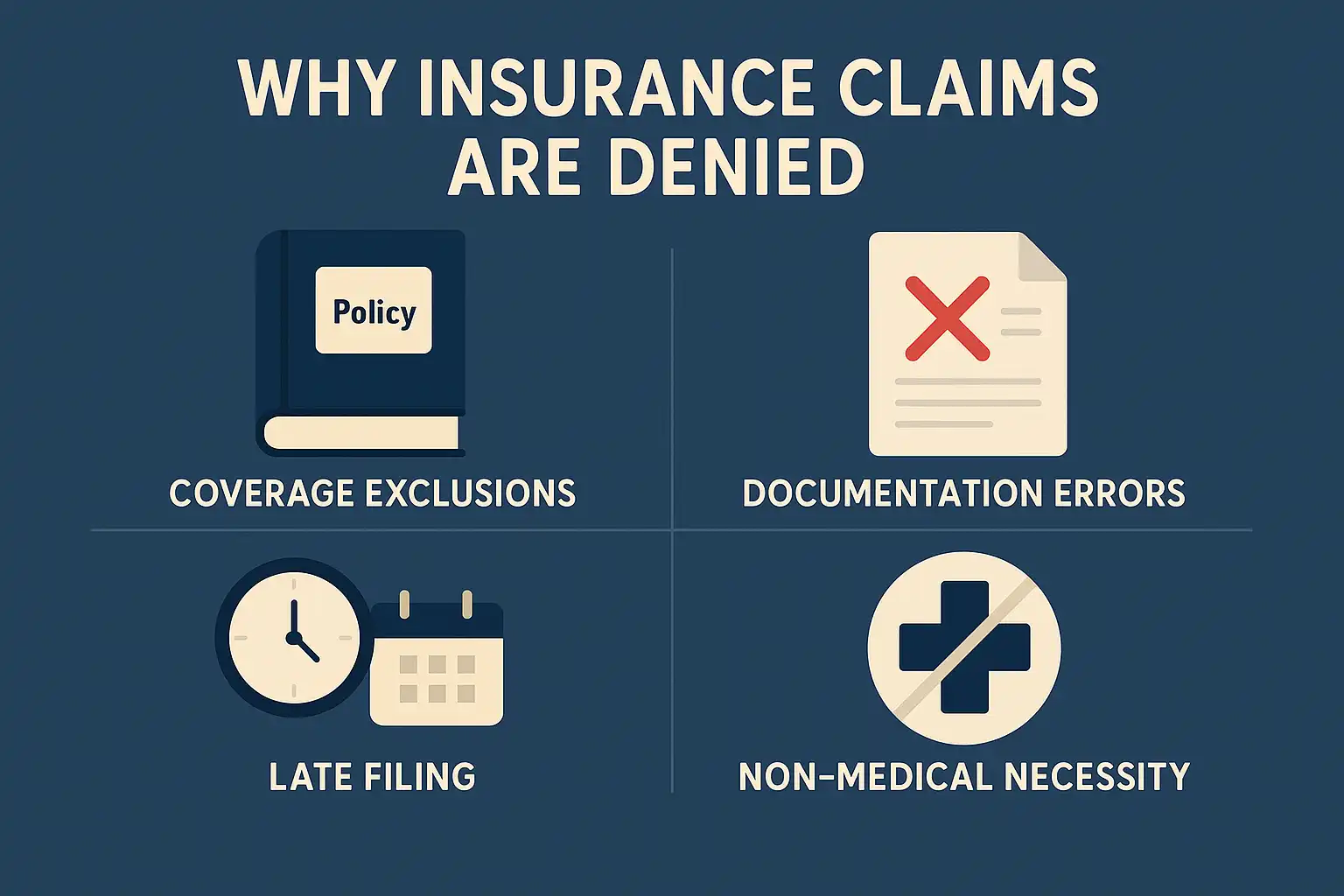

Insurers often deny claims for one or more of the following:

Knowing the insurer's reason gives you a strong footing for reversing the denial.

North Carolina law requires insurers to offer a clear internal appeals process. You must submit your appeal, along with corrected or additional documentation, by the deadline in your denial letter. This is often health insurers following federal mandates via HealthCare.gov guidelines.

If the internal appeal fails, certain health and auto claims support independent external review. For other types, NC’s Department of Insurance handles complaints. They investigate patterns of unfair claim handling.

North Carolina law lists 14 unfair claim settlement practices under N.C.G.S. § 58‑63‑15(11), including:

Although this statute doesn’t grant a private right of action, violations like these can still breach consumer protections under N.C.G.S. § 75‑1.1 (Unfair and Deceptive Trade Practices). Courts have confirmed these actions can qualify as unfair trade practices, even without showing a pattern—so long as bad faith or deceptive intent can be proven.

If your appeal succeeds, you’re entitled to the full amount under your policy—potentially with interest for the insurer's delay.

NC law allows recovery of attorney fees under N.C.G.S. § 75‑16.1 when unfair or deceptive practices are proven.

Courts may award triple damages if insurer conduct violated N.C.G.S. § 75‑1.1 and caused financial harm.

If your insurer knowingly refused a valid claim or engaged in deliberate deception, you could pursue punitive damages and breach of contract awards under North Carolina common law and statute.

Our team:

Yes, but insurers respond faster—and more fairly—to well-documented, legally backed appeals.

Repeated delays, misleading statements, refusing valid claims, or offering lowball settlements can all qualify.

A denied claim isn’t the end—it’s a checkpoint. You have legal tools to appeal, hold insurers accountable, and get the compensation you deserve.

Contact Paul Robinson Law now for a free evaluation. No fees unless we win your case and recover for you.

Call Us At

919-438-0065

105 S Ellington St, Clayton, NC 27520

124 St Marys St Ste 201, Raleigh, NC 27605

800 W Williams St #250 Apex, NC 27502

Clayton Office:

Phone : 919-438-0065

Raleigh Office:

Phone : 919-471-3200

Apex Office:

Phone : (919) 944-4630

105 S Ellington St, Clayton, NC 27520

124 St Marys St Ste 201, Raleigh, NC 27605

800 W Williams St #250 Apex, NC 27502

Copyright @2026 The Law Offices Of Paul Robinson. All Rights Reserved.

This site is for information purposes only. No attorney-client relationship is created by use of this site. No legal advice is intended by its use. An attorney-client relationship is only created speaking to an attorney and signing a representation agreement.

By providing your phone number, you agree to receive text messages from Paul Robinson Law, PLLC. Message and data rates may apply. Message frequency varies.